Understanding the Titration Matrix

There is no rule book on how to assess an NFT valuation. The metrics you use to evaluate private companies or conventional investment vehicles such as stocks are simply not applicable to NFTs. Usually the payment made by the last buyer gives some indication of value. For NFTs, however, it’s hard to guess how much the next buyer might pay, based on their estimates. Most buyers lack the skills to determine the value of NFTs logically and base their quotes on guesswork. For sellers too, it is difficult to determine what they could end up receiving for the tokens they hold. Over time, the value of NFTs depends on a perception over which both buyers and sellers may have no control. An example can drive home the point even better. An NFT artwork may be in high demand for a period of time, with potential buyers assuming it is rare and expecting value in the near future. Then suddenly they may find that the digital image is available on the internet for free and there may be no buyers left for the NFT.

Factors determining the value of NFTs

NFTs of works of art by renowned artists or tokens associated with tangible assets of reputation may have defined values. However, in most cases, it is difficult for investors and traders to determine the value of an NFT.

Rarity

The demand for an NFT is directly proportional to its perceived scarcity, but how can you tell how rare an NFT is? One-of-a-kind works of art from renowned illustrators can be good examples of rare NFTs, as can tokens minted by A-list celebrities. Some rare items in the game can also successfully call this category. The rarity factor brings a lot of intrinsic value to these NFTs.

An immutable proof of ownership gives the NFT holder a sense of distinctiveness and, subsequently, value. Everyday’s The First 5000 Days by Beeple and Jack Dorsey’s first NFT are great examples of NFTs with an element of rarity.

Utility

To find out how to evaluate NFT projects, utility emerges as a key parameter. To have value, an NFT must have a utility in a real application. For example, NFTs could be used to tokenize real estate, precious metals, and even securities; to represent virtual terrain or game assets and in many more ways. The world of NFT is still in its infancy, and as it matures, innovative new use cases are sure to emerge. Immediately after minting, an NFT derives value from its inherent characteristics. Over time, the value accumulates based on the usefulness and community strength of the underlying project. Decentralized NFTs and, which refer to virtual land in the project, are an excellent example of such tokens.

Tangibility

NFTs associated with real-world objects draw an element of tangibility. Hit with property immutability in blockchains, it creates immediate value in tangibility. NFTs can be used effectively to underline proprietary rights and eliminate instances of fraudulent activity. The practical use of NFTs in the projects they are involved in influences their value. NFTs that have a tangible value are perfect for short and long term trading. Some NFTs, like tickets, may have expiration dates, while others, like those representing real estate, may build more value over time.

Interoperability

A key factor in the NFT value proposition is interoperability, that is, the ability to use the tokens in different applications. For example, if the same weapon can be used in different games, there is a better chance that the token will accumulate value. The way non-fungible tokens work on different blockchains will always simplify transactions. However, interoperability is difficult to achieve, as developers have to build a vast network of applications in which the tokens can be used. A set of compelling use cases help infuse NFT interoperability. Another strategy that developers could follow is to develop partnerships with other projects to provide benefits to the people who own their tokens.

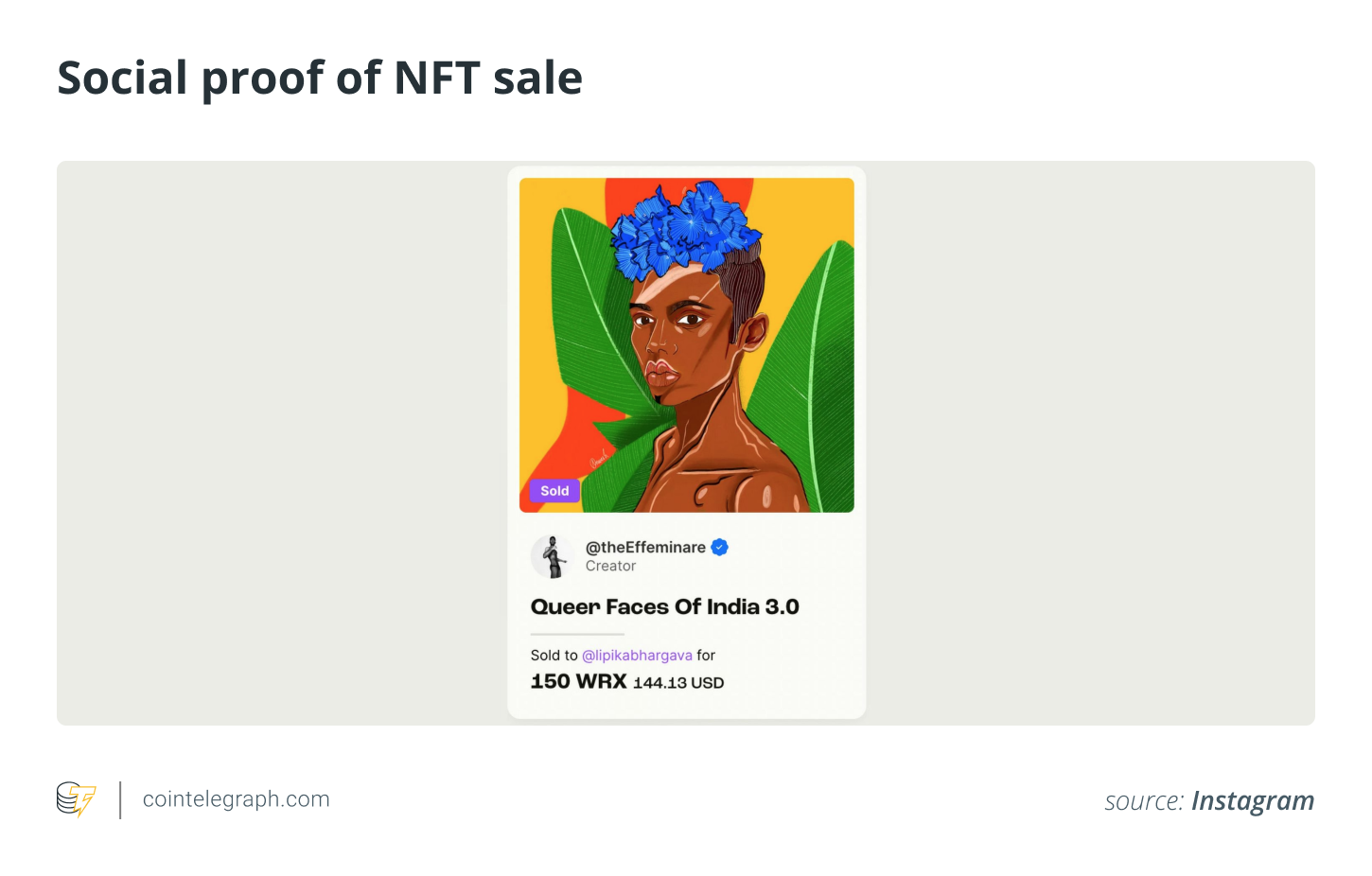

social proof

The social proof associated with the project behind an NFT is one of the deciding factors that determine the value of the NFT. Checking out their profiles on social media platforms like Twitter and Instagram can help gauge their acceptability. If the numbers are low, it indicates that they have not yet been able to create a solid foundation for themselves.

When you first encounter any person or project, there is a natural tendency to take cues from the people around the project. Social proof indicates what people, in general, think about a project and helps make a decision.

ownership history

The identity of the issuer and previous owners of an NFT influence its value. Tokens created by eminent persons or corporate entities benefit from high historical ownership value. You can enhance the value proposition of NFTs by partnering with individuals or companies with strong brand equity to issue NFTs. Reselling NFTs previously held by influencers is another way to gain traction. Marketplaces and sellers can help buyers find information about previous owners of NFTs by providing a simple tracking interface. Highlighting the addresses of investors who took home a good deal from the NFT trade will help buyers gain valuable insights.

liquidity premium

Highly liquid NFTs also have a higher value. Secondary markets provide a place to trade frictionless standard ERC or BSC NFTs, giving buyers immediate access. Traders prefer to put their money in NFT categories with high trading volume as higher liquidity helps them make their profits with ease. A highly liquid NFT is likely to retain its value even if the associated platform is closed. The token economy emphasizes increasing engagement, and subsequently liquidity will drive the value proposition of NFTs upwards. A built-in system that depreciates NFTs when sitting idle for a long time and encourages competitive assets can help build a strong market. As the NFT market grows, systems will be put in place to support asset liquidity.

Speculation

There are times when speculation becomes the catalyst behind price appreciation, for example the price of CryptoKitty #18 slipped from 9 ETH to 253 ETH in just three days in December 2017. While a line of thought is critically opposed to speculation as one of the drivers of valuation, speculating is natural to human beings and cannot be eliminated in practice. Even in the conventional financial system, instruments like derivatives are based on speculation. In this sense, that speculation becomes a non-trivial component of the NFT ecosystem is not a surprise. NFT item price performance charts, changes in assets underlying projects, and even events beyond your direct control can encourage speculation and drive NFT prices up.

Continuous change in the NFT ecosystem

NFTs are a nascent ecosystem in continuous evolution. Several factors influencing the value of NFTs are rapidly evolving, and to increase accuracy, you need to take them into account. Also, value is broadly a subjective concept, although you can argue that the discussion is about intrinsic value. In this scenario, figuring out how you determine the future value of NFTs becomes even more challenging. Since NFTs are an asset class with infinite possibilities, we can safely assume that their versatility will constantly grow and lucrative opportunities will be available in various sub-categories. The number of NFT use cases has been increasing at a great rate. Now NFTs can be used in applications such as ticket distribution to secure voting rights. As you explore an NFT value estimator, just keep in mind that all things that glitter are not diamonds. So be patient and consider a wide range of factors when coming to a decision. At a time when all kinds of NFT markets are emerging, from all-inclusive platforms like OpenSea to niches like Real Nifty, doing your due diligence and making an informed decision becomes especially important.