What Is Compound Interest?

Compound interest in a nutshell is, ‘interest on interest’. It is when someone receives interest, usually in the form of dividends and they reinvest the interest into their original principle. What then occurs over time, is a snowball effect. You begin gaining interest, on the interest that you previously received and can be left with a large sum of money over long periods of time. Famously, Einstein once described compound interest as ‘the eighth wonder of the world”, adding: “He who understands it earns it; he who doesn’t pays it.”

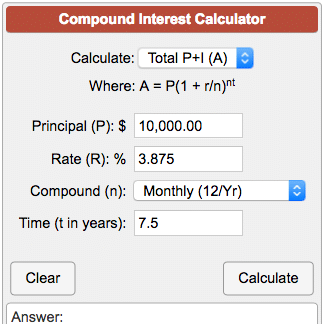

Calculating Compound Interest

The standard formula for the compound interest calculator is A = P(1+r/n)(nt)

- A = the future value of the investment

- P = the principal investment amount

- r = the interest rate (decimal)

- n = the number of times that interest is compounded per period

- t = the number of periods the money is invested for

Compound interest calculator with dividends

Despite all the theory we have worked on a great compound dividend calculator for you. Forget complicated formulas or mathematical knowledge. With our dividend snowball calculator you will see the snowball effect rocking it.

Choose a currency, the initial investment, the annual interest and how many years you will be investing.

What investments Can You Make To Take Advantage Of Compound Interest

One of the simplest and most efficient ways to take advantage of compound interest is through dividend stock investing. For example, HSBC offers a close to 7% dividend. Now of course you can get lower and you can get higher. But HSBC is one of the biggest banks in the world and a global force. Not only do you get the dividends (interest) you also get the capital gain. Although this is normally lower than growth stocks (stocks that do not pay dividends). So let’s look at an example:

We will put down a principle investment of $10,000 at 7% and we will invest $500pm. After a 20 year period, your total value will be just over $300,000. This could also be higher if the price of HSBC’s stock were to rise over the next 20 years, which you would expect it too.

Other Related Calculators:

There is a lot of talk about whether one should pay off their mortgage early. In a way it is a reverse compound interest calculator, as the paying off the interest reduces your costs significantly over time. For more info, check out our mortgage overpayment calculator.