StargateFinance has been trending on Twitter for the past week and while it is too early to call for a full-fledged DeFi bull market, traders have been pumping funds into the project, which claims to be a “composable omni-chain native asset bridge” . Data from Cointelegraph Markets Pro and TradingView shows that STG was listed on exchanges on March 17 and its price rose 438% from a low of $0.665 to a high of $3.58 on March 25.

STG/USDC 1 hour chart. Source: TradingView Here is a look at some of the developments with the protocol that attracted DeFi users and increased the price of STG before its initial community auction.

Cross-chain composability

Interoperability has been a growing theme throughout the cryptocurrency ecosystem and this theme continues to expand as investors realize that the future Metaverse will be comprised of multiple interconnected blockchains. While many of the older DeFi protocols have yet to develop a plan to integrate the most popular chains, Stargate was designed with cross-chain compatibility as its core feature. This allows a cross-chain transfer to be compounded with smart contracts on the destination chain. According to Startgate Finance, this helps simplify the exchange process and maximizes the degree of flexibility by making the process more convenient for users and opens up new opportunities for cross-chain applications. The project also offers guaranteed instant finality, ensuring that any transfer requests committed in the course chain will also be committed in the destination chain. Unified liquidity eliminates the need for intermediate tokens, as each supported chain has a liquidity pool for native supported assets. Networks currently supported by StargateFinance they include Ethereum (ETH), BNB Smart Chain (BSC), Polygon (MATIC), Avalanche (AVAX), Arbitrum, Optimism, and Fantom (FTM).

Hype builds over community auctions

A community auction starts on March 30 and users who got pre-approved for their wallets or bonus funds before March 17 are eligible for SGT tokens priced at $0.25. Tokens purchased during the auction include a one-year lock, followed by a linear unlock period that lasts six months. Pre-approved accounts can purchase a maximum of 18,657 STG, while consolidated accounts can earn up to 4,668 STG. Any tokens left over after Round 1 will be split evenly and available for purchase in Round 2 for those who earned the maximum eligible amount during Round 1.

High yields of stablecoins

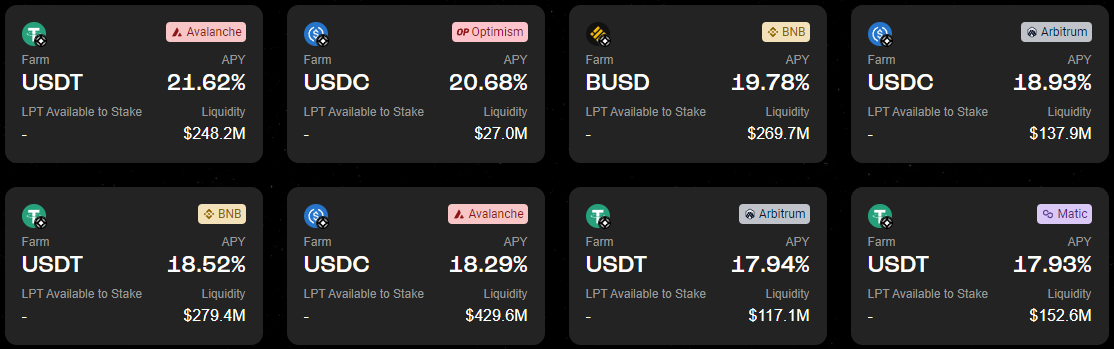

A third factor that helps attract attention and users to Stargate Finance is the attractive farming returns of stablecoins on their supported networks.

The highest performing stablecoin farms on Stargate. Source: Stargate High stablecoin yields have already managed to attract $2.95 billion in liquidity locked into the protocol, according to data from Defi Llama, making Stargate Finance the 13th largest DeFi protocol on TVL.

The highest performing stablecoin farms on Stargate. Source: Stargate High stablecoin yields have already managed to attract $2.95 billion in liquidity locked into the protocol, according to data from Defi Llama, making Stargate Finance the 13th largest DeFi protocol on TVL.

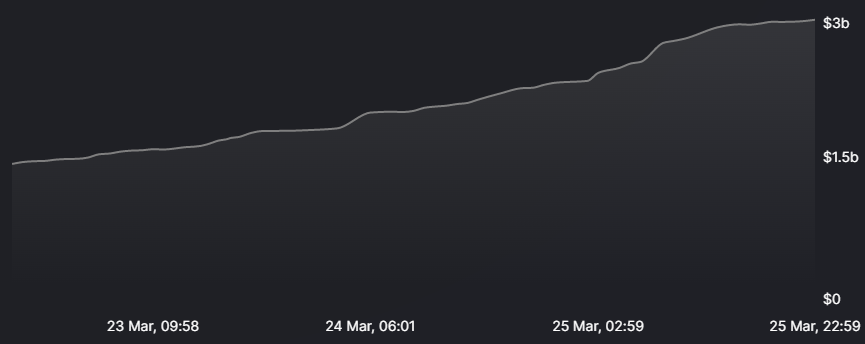

Total value locked in Stargate. Source: Defi Llama While it is still too early to tell how Stargate Finance will fare in the long term and whether its token price can sustain its recent gains, it appears interoperability and a focus on stablecoin liquidity are the two key factors needed for DeFi protocols seeking longevity in the crypto ecosystem. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.

Total value locked in Stargate. Source: Defi Llama While it is still too early to tell how Stargate Finance will fare in the long term and whether its token price can sustain its recent gains, it appears interoperability and a focus on stablecoin liquidity are the two key factors needed for DeFi protocols seeking longevity in the crypto ecosystem. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.