determining factor is going to come down to your ability to save money. If you lack the discipline to do this, then I’m sorry but your doomed. I know doctor’s who had to take a loan this month to cover their child’s private tuition. It’s not all about what you earn, it’s how you manage it. It’s financial literacy.

You’ve got to get a check on your income and expenditure sheets. You need to know what’s coming in and what’s going out and you need to plan. I use a really basic spreadsheet on Numbers (Mac software similar to Excel). Below is how I set it out and how I would suggest you do yours, keep it simple and keep it visual. You can also use an app to help, a good free app for tracking expenses is Money Dashboard.

Why save money?

The main reason you have to save money, is because to build any business, I don’t care what anybody says, you have to spend. Unless its online surveys, pretty much every model based around making money will involve you investing. Whether it’s investing in property, investing in yourself (perhaps a course) or reinvesting into your businesses inventory, you have to have some capital.

Currently, the challenge for many people is aiming to be saving 500 a month. It is not difficult to get it. In fact, we have prepared a list of 17 things you can do to start saving this amount today.

Of course every person’s situation is unique but if you can aim to save £250-500pm, then that’s £3,000-£6,000 saved every year. In 3 years you have close to £20,000. From here things will snowball as I illustrate at the bottom of the blog post. I would recommend you to save money personally and reinvest your business profits back into the business. If you’re working and living at home with parents, you have to take advantage of this massive opportunity.

So let’s go, 17 ways to stop squandering money on useless things as follows:

1. Buying food or hot drinks at work every day

This is lazy and wasteful. The average meal from a shop or bought at work’s canteen is £5. You can bulk cook and save a lot of money plus you get healthier and leaner at the same time as you know what you are putting in your food.

Money Saved: £100pm

2. Smoking

I know this is difficult for a lot of folk and this will switch people into defensive mode. But not only is this habit making you broke, it’s killing you. For information on how to quit smoking check out Smoke Free Future. The average pack of 20 cigarettes in the UK costs £10.00 dependent on brand. The average smoker smokes 15 cigarettes a day. Cut that out and see physical and financial gains.

Money Saved: £225pm

3. Designer clothes to keep up with the Jones

Come on man, stop livin’ life for the Gram. No one really cares about pictures of your spiky trainers on Instagram or your oversized awful looking brown bag. We know you’re not rich so it’s time to quit pretending. By all means once you’re earning some serious money, go ahead and blow three grand in Selfridges. But if you’re earning under £10,000pm limit your time dressing to impress.

Money Saved: £200pm

4. Eating Out too often

An obvious one, and one I used to fall victim to myself. Every time me and the wife went out to the city centre we would always get a Nando’s. I’d do this twice a week. For both of us it would cost around £35. £35 x 2 a week over the month soon adds up. In fact its £280.

Money Saved: £280pm

5. Car Insurance

Please make sure you shop around. The biggest is trap is when you are auto enrolled. The kind insurance companies will gladly add an extra 20-50% to your premium without you even noticing. Stick it in the diary. Stay in control and in most cases switch every year. Don’t let these vultures steal your money.

Money Saved: £150pm

6. Electric and gas bills

I did this one myself last year and found out that I was getting stung heavily by EON. Make sure you know which tariff you are on and shop around. Once you have done a meter reading, see how many watts you are using and you will get an estimate from other companies. I saved £100pm doing this.

Money Saved: £50pm

7. Interest on car loans

I know the car is nice and the dealer is pressuring you but you need to pay attention here. In general you are going to lose a lot of money on a PCP deal. And if you get a HP you better know the interest rate. Why waste the money when you can just get a good low rate loan and buy the car. Check out Car Finance 24/7, I used these before (just paid it off) and saved a hell of a lot of money on interest payments.

Money Saved: £75pm

8. Food bills

After our mortgage or rental payments, food is the biggest cost in a household and therefore one where money can be clawed back. Actually thats a lie, tax is the biggest expense, but that’s for another time.

Aldi is not that bad! Again pay attention, I know most of this audience won’t shop at Waitrose but take a look at what you’re buying and look for substitutes. Maybe the butcher is cheaper to get your meat, or maybe you buy a water filter instead of buying bottles of Volvic. Make a list of everything or go through your receipts and look where you can make a change (no pun intended).

Money Saved: £80pm

9. Gambling

Been and there and done that. You have a little flutter on the football. You lose but you was close. So you chase the money but this time at better odds which means more risk. Aguero misses an open goal on the 90th minute and now you’re £100 down. Remember people, the bookies always win. Just leave the betting alone and focus on building a business. It’s not a way of building wealth, its addictive and dangerous. Focus on the long term and how you will become financially secure.

Money Saved: £100pm

10. Nights out or time in the pub

Not only are you wasting your hard earned money on alcohol, peanuts, bags of crisps and the fruit machine. You’re not exactly surrounding yourself with life’s winners. If you want to move forward in life, I’m sorry but the answers aren’t in the Wetherspoons. I’m not saying you can’t have a tipple, but 3 nights a week in the pub is self sabotage.

Money Saved: £50pm

11. Scratch cards

Come on, you’re only giving it away. The odds of winning a decent amount on a scratch card around get a grip to 1. 5x scratch cards a week is £40pm. It all adds up. Flip your mindset. You should be thinking how can I get 1000x people to buy a scratch card for £2 and pay out £500 in prizes. That’s £1500 profit ;).

Money saved £40 pm

12. Cashback sites

Utilising sites like Quidco is pretty much free money. I need to do this more myself. I did just get £20 in Amazon vouchers but my friend has earned hundreds of pounds. Quidco will give you cash back when you buy through them at places like Trainline, Expedia, EE etc. If you’re going to spend it you may as well do it through them.

Money Saved: £25pm

13. Advance train tickets

If you know you’re going somewhere in a few weeks time. Don’t leave it until the last minute (like I usually do). Get it booked in advanced and save up to as much as £75 on a pair of tickets!

Money Saved: £10pm

14. Council Tax

If you’re single, a student or have a disability, or even your house is banded incorrectly. Check it out and stop overpaying https://www.gov.uk/council-tax/discounts-for-full-time-students

Money Saved: £25pm

15. Borrowing friends your last £100!

I know it feels like a nice thing to do at the time and I’m not saying turn your back on your friends because after all they’ll give it back next weekend, right? Until you see on Facebook that they’ve been on 3 nights out and got a new pair of trainers. Only lend money if you can afford to write the debt off. And don’t be fooled twice by the same person.

Money Saved: £25pm

16. Claiming money back on delayed flights

This can bring in some tidy profits. I have made money off this myself before (well the wife did). But if you’ve being sitting around in the airport because the airline cancelled your flight. Check out what your’e owed at Flight Delayed, you should always do this if you are victim to lengthy delays.

Money Saved: £25pm

17. Fuel

Shop around. The highest petrol price currently is £1.74 and the lowest is £1.16. If you drive a lot, why give it to them? Top up at Asda or Sainsbury’s and save the money.

Money Saved: £20pm

Bonus (Real Life Saving Example)

The bottom line is you must save your hard earned income. And secondly you must invest what you have saved. Saving for saving’s sake is for losers, you’ll never be financially independent staring at a number on your online bank balance or hanging on to a set number of £’s for dear life.

Let me give you a real life example of what discipline with savings can do.

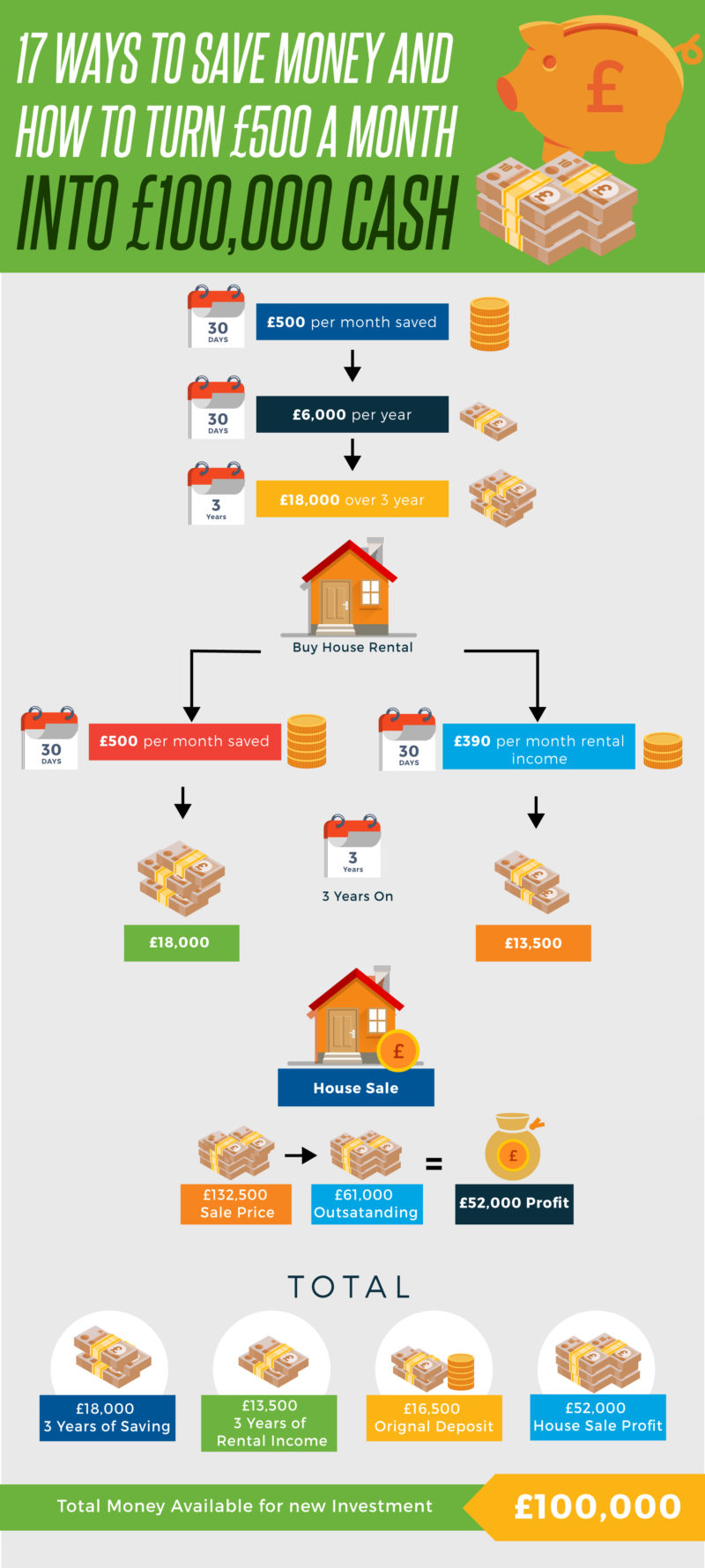

You managed to save £500 a month which is £6,000 a year. In 3 years this is £18,000. My first purchased property was £84,000. I put around £16,500 down. I make £390pm net profit pm.

£390 rental income a month is £4680 a year. Let’s round it down to £4,500 for any painting or repairs. So over 3 years that is £13,500. Now let’s add this to the £6,000 a year you’re saving already. That’s £31,500 in 3 years! On top of the equity in the house.

And the best bit, I am now selling this property and have just agreed £132,500. £132,500 – solicitors fees – estate agent fees – early repayment charge = £68,000. £68,000 – £16,500 (deposit) = profit of £51,500. Plus £13,500 (rent) = Total profit of £65,000 from 1 property.

Add to this your original deposit of £16,500 and add your yearly savings (3 years) of £18,000pm (£500pm). All of a sudden you have £100,000 all from saving £500pm. This is from a total of 6 years of saving £500pm. And now if you choose to put this £100,000 a month into your next property, you could earn around £20,000 per year (both of my properties do 20% ROI) Which is just over £1,650pm. This is a full time wage. You could live off this and focus on building an online business or you could rinse and repeat until you are happy with the monthly income.

So stack that money and go on the offence. What are you waiting for? Get y